I wish I’d applied this law more regularly to my start-up creation. It's pretty simple, know what pain your product/service resolves, and secondly, does this pain have a budget, and can I get access to the person who owns that budget? This is critical! There are many things organizations should do, but don't. There may also be many people working in that organization that may love your offering and can see its application but don't own the budget for it and therefore are reduced to influencers at best. I’ve even encountered people evangelizing the benefits of My start-up, Sanctifly, yet refusing to make an introduction to the decision maker, citing that ‘it’s against company policy’. A strange policy but there you go - Pain with Budget and an identified, reachable budget owner. Be careful not to pitch a solution requiring a decision-maker that's too senior in an enterprise (I.e. company of 1000+ staff). This is a really tough initial target market. More on that later. First the pain. The more pain the better! And the lower budget you can resolve that pain, the more disruptive you can be. Hey, we all want to travel first class, but most of us don't have the budget! I deliberately use the word Pain because I believe start-ups should challenge their proposition to identify what it resolves and what's the ‘pain’ endured by ‘going without.’ Be a pill, not a vitamin. Don't be a nice-to-have. Some simple everyday examples are Solution Pain to be without Health Insurance Credit card clearance Cloud data storage (SAAS) Music / Movie Steaming Club membership

The principle of this ‘Magic Matrix’ remains the same. There are four quadrants: Low pain/Low Budget, High Pain/ Low Budget, High Pain/High Budget, and High Budget/Little Pain.

In there really is one killer block you want to be in: High Pain/Low Budget. The joint seconds (Low Budget/Low Pain and High of Pain, High Budget) are really far behind and place a huge demand on your marketing or staying power to get the niche traction you need to survive, but you’ll never be a ‘killer app’.

Think about all the global brands and unicorns over the last 10 years and apply them to the matrix. B2C Offers like Spotify, Amazon Prime, Netflix, Revolut, and Robinhood, and B2B offers like Stripe, Stack, and Dropbox all follow the same set of rules; really low budget (financial and tech) cost of entry, no risk terms and typically an initial commitment of only one month. They also offer huge onboarding support ( the Collison install is stuff of legend and the go to model for so many) and massive product benefits straight out of the box: Take credit cards payment platforms, music and movies on demand, free deliveries, international banking. I’m old enough to remember that getting registered with a bank to take credit cards was a 60-day process with lots of forms and normally a holding deposit. It's now less than a day! The pain relief and benefits are enormous! These essential onboarding product features are crucial to reducing the pain point and moving any product or service into the killer green quadrant.

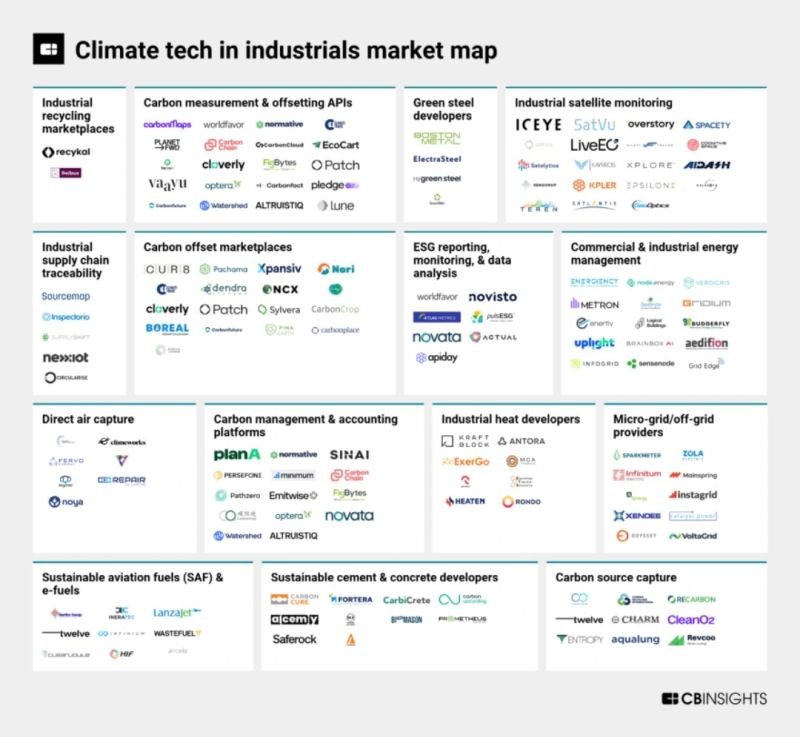

Recently we had to drink this cool aid at my start-up Stanctifly. If I'm honest, Sanctifly falls into the low-pain box. Upgrading our travel downtime and traveler wellness for employers is not seen as a high pain or need purchase. Neither is music and movies on demand, and that didn’t work out too bad for Spotify and Netflix! So, I need to ensure that we do not fall into the High-Budget box as well. That’s the death nail. When we launched five years ago, we set our price and model copying the market leader: an annual membership Budgeting $295. We did ok, and sold a couple thousand. Today, we’ve flipped it completely; we are less than $10 per month, cancel anytime. Simple and very familiar to consumers. Even with the pandemic restart the travel industry went through, we now count our members in the tens of thousands. Exercise. Where does your start-up fit in the matrix? Are you middle of the box or on a boarder? Where do your competitors and comparators fit? Who is the current market leader? It's an interesting exercise to put all the competitors into the matrix, even if you apply an unconscious bias, it can tell a story. A real acid test is to ask others, potential customers, to place you somewhere in the graph. A Pattern always immerges. Good, now the next step. The more pain, the more budget is possible One solution I believe is about to shift boxes is carbon accounting solutions. Today, many organizations see the requirement to track their GHG ( GreenHouse Gases) and record their progress in reducing them, appears like a High-Budget/Low Pain issue - where is the RoI in the significant work and change? But organizations that continue to ignore do so at their pearl. Most western countries have signed up for GHG/ ESG goals of reducing carbon emissions by 51% in 2018 vs. 2030. Big Business have already restricted their supplier and tender responses to compliant companies and investors are taking it seriously, only putting their money into responsible organisations. This burning platform will need to box shift - The solution that can go to Low Budget whilst the pain moves to High Pain will be the disruptive leader. A few options are working towards this, so an interesting space.

Another area in shift is insurance. Typically an annual cost for most households and organsations with a limited tangible connection between behavior, activity, and the underwriter during the term. In fact, how we buy and pay for our car, home, life, and health insurance has not changed that much in the last 100 years. I can see new disruptors like Vitality and YuLife are taking a fresh approach to reward good behavior, but still, it looks like an opportunity to do so much more, particularly in home and property. I use the word Budget and not Cost deliberately. The cost or price of your offer is a singular force or metrix. The budget needs to allow for a lot more. Planning, onboarding, transition, decoupling from an existing solution. Cost evaluation comes after the budget has been allocated. No budget, the cost is irrelevant. All of these factors should be considered in determining your solution’s budget. You can give it away, but if the non-financial costs are too high, companies may still not bite. Also, note the planning phase; even if it's low budget/high pain, you still need to find the budget holder in the company. Very few products can create a budget mid-year. If your product or solution is not in the forecast with finance, it doesn’t matter how good value it is - it's not going to get purchased. This is especially true the larger the organization. Enterprise sales might look like the pot of gold, but they are the hardest and longest-won sales any start-up will ever gain. There have been many super software solutions developed that died an early death because they couldn't get to the budget owner or disrupt the incumbent enough to get the necessary traction. Having a great solution at the right price is only half the battle! So, even if you can defend your position as a low-Budget/high-pain solution, you need to know with absolution certainty you can get to the decision maker ( budget holder), and that they have an allocated budget for your offering. This normally means you have an incumbent vendor ( existing provider), which means you need to disrupt. And that's a different day's work.

Pick a Pain with a budget Know what quadrant you fit in If not green, can you put pressure on it to move it closer Identify the budget holder That budget exists, and it is greater than your total cost to implement.

Before you cash in your secure jobs chips, meet with a couple of these budget holders. Remove as many variables as possible in your proposition before you burst out of the blocks.